Navigating Market Waves: A Guide to CFD Trading

In the ever-evolving landscape of financial markets, traders and investors are constantly on the lookout for innovative ways to maximize returns. One such method that has gained significant traction is CFD trading, or Contract for Difference trading. This article aims to provide a comprehensive guide to navigating the market waves through CFD trading, shedding light on its mechanics, benefits, and strategies.

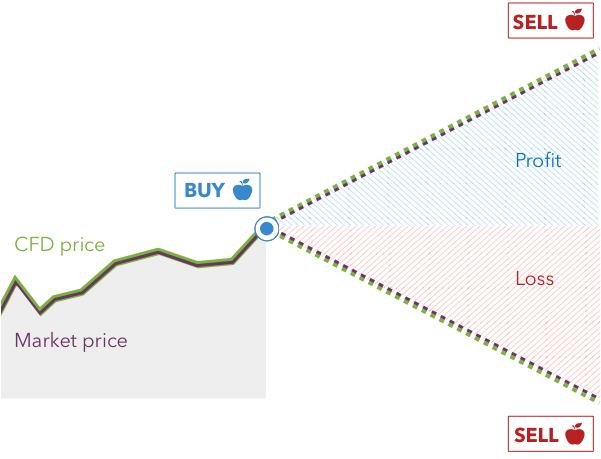

CFD trading involves a contract between a buyer and a seller, stipulating that the buyer will pay the seller the difference between the current value of an asset and its value at the contract’s end. Unlike traditional trading, CFDs allow traders to speculate on price movements without owning the underlying asset. This unique feature opens up a plethora of opportunities for savvy traders.

Benefits of CFD Trading

Leverage

One of the standout features of CFD trading is leverage. Leverage allows traders to open positions much larger than their initial investment, magnifying potential gains. For instance, with a leverage ratio of 10:1, a trader can control a $10,000 position with just $1,000. However, it’s crucial to remember that leverage also amplifies losses, making risk management paramount.

Diverse Markets

CFD trading offers access to a wide range of markets, including stocks, commodities, indices, and forex. This diversity enables traders to diversify their portfolios and capitalize on various market conditions. Whether you’re interested in tech stocks or precious metals, CFDs provide a gateway to multiple asset classes.

Short Selling

CFD trading facilitates short selling, allowing traders to profit from falling markets. In traditional trading, short selling can be complicated and costly. With CFDs, short positions are straightforward, enabling traders to hedge against market downturns or speculate on declining prices.

Key Strategies for CFD Trading

Technical Analysis

Technical analysis is a cornerstone of CFD trading. By studying historical price charts and patterns, traders can make informed predictions about future price movements. Key indicators such as moving averages, relative strength index (RSI), and Bollinger Bands are commonly used to identify trends and potential entry and exit points.

Fundamental Analysis

While technical analysis focuses on price patterns, fundamental analysis examines the underlying factors influencing an asset’s value. This approach involves analyzing economic indicators, earnings reports, and geopolitical events to gauge market sentiment. Combining both technical and fundamental analysis can provide a more holistic view of the market.

Risk Management

Effective risk management is crucial for long-term success in CFD trading. Setting stop-loss orders, diversifying positions, and using appropriate leverage ratios are essential components of a robust risk management strategy. By minimizing potential losses, traders can protect their capital and stay in the game longer.

Demo Trading

For those new to CFD trading, starting with a demo account is highly recommended. Demo accounts allow traders to practice strategies and gain experience without risking real money. This hands-on approach builds confidence and hones skills before transitioning to live trading.

Navigating Market Waves

The financial markets are akin to ocean waves, constantly shifting and changing. To navigate these waves successfully, traders must stay informed, adaptable, and disciplined. Continuous learning, staying updated with market news, and refining strategies are key to riding the waves of the market.

Conclusion

CFD trading presents a dynamic and flexible way to engage with the financial markets. Its unique features, such as leverage, diverse market access, and short selling, offer numerous opportunities for astute traders. By employing effective strategies and maintaining rigorous risk management, traders can navigate market waves with confidence and skill.

Whether you’re a seasoned investor or a newcomer to the world of trading, CFDs provide a valuable tool for enhancing your trading arsenal. Start your journey today and explore the exciting possibilities of CFD trading.