The Different Types of Medical Supplement Plans: How to Choose the Right One for You

Health insurance could be a Mutual of Omaha Medicare Supplement confusing topic, specially about healthcare supplement ideas. There are so many different types of plans available, and it can be difficult to know which fits your needs. Let’s discuss the several types of Mutual of Omaha Medicare Supplement plans, enable you to decide which one particular is perfect for you, and look at the info on choosing the right medical insurance prepare and things to look for when comparing plans.

The Sorts:

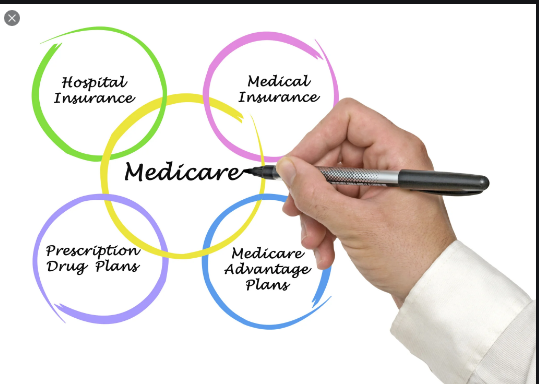

You can find three health-related supplement ideas: Medicare Benefit, Medigap, and Medicaid Development.

Medicare health insurance Advantages Plans:

These plans are provided by private insurance firms and accepted by Medicare health insurance. They provide the identical protection as Original Medicare health insurance (Parts A and B). Continue to, they may provide additional rewards, such as prescribed medicine insurance or dental and vision attention. You need to shell out a monthly high quality for this Mutual of Omaha Medicare supplement ideas.

Medigap Strategies:

These plans are offered by individual insurance providers and can assist you purchase out-of-bank account fees not covered by Original Medicare insurance, including deductibles, copayments, and coinsurance. There are actually ten diverse Medigap programs, each and every with various insurance coverage amounts. You will have to spend a regular monthly high quality for such strategies.

Medicaid Enlargement Plans:

These plans are available by federal and state authorities and expand the coverage of Medicaid to include more low-earnings men and women. You may be entitled to these plans when you have a incapacity, are pregnant, or are 65 years or old. You simply will not must pay a month-to-month top quality for these plans, but you might need to spend other out-of-pocket expenses, for example copayments or coinsurance.

Since we’ve considered the three health care health supplement plans, let’s talk about choosing the best for you. Very first, you’ll should consider your overall health care requirements and spending budget. When you have a long-term health problem or consider several prescription drugs, you’ll want to make certain that the plan you decide on covers your requirements. You’ll should also take into account whether you require oral and eyesight proper care coverage. Once you’ve deemed your preferences, start comparing programs.