How do you get benefits from Medicare insurance plan?

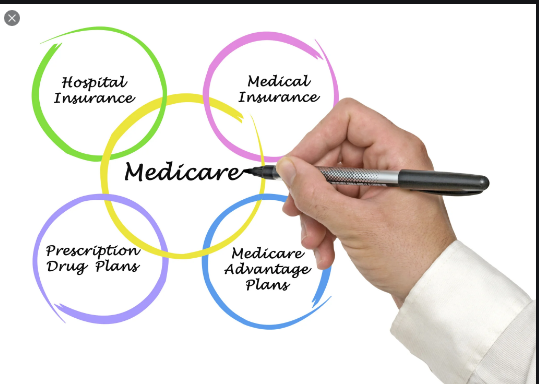

There is a basic question That Is requested By way of a great deal of people and that is if they should get subscribed to Medicare Advantage plans 2021 or maybe not. Because there exists original Medicare plan as well and it is not a simple decision to make while selecting the insurance coverage plan, the majority of men and women get confused while picking the insurance program. This is a plausible question and before you evaluate some other insurance program, it is very important to know the conspicuous features of all the alternative plans. In this case, you need to learn about Medicare Part A, part B, part C and part D at exactly the exact same time so that you may earn an appropriate choice. In the following piece, we’ll discuss the extra benefits which you like whenever you pick Medicare Advantage plans for 2021 by a Medicare Advantage plans for 2021 trusted insurance carrier.

Features of becoming Medicare Advantage insurance plan:

If you Sign up to first Medicare Insurance plan that you can only have hospital benefits and medical advantages. For additional benefits you have to subscribe to part Dwhich isn’t covered in neither Part A nor Part C. In order to eliminate this specific issue, the national insurance agencies introduced a brand new plan which merged all the current plans now you could avail the medication prescription through this special plan.

You can change your insurance plan for Your personal conditions with Medicare advantage and also this is the very best part which many individuals are appreciating today. Once you register to such an agenda that you can avail the rewards to finding a co ordinated medical support which will be needed whenever you have a chronic disease.